Tenant Data Isolation: Patterns and Anti-Patterns

Explore effective patterns and pitfalls of tenant data isolation in multi-tenant systems to enhance security and compliance.

Jul 30, 2025

Read More

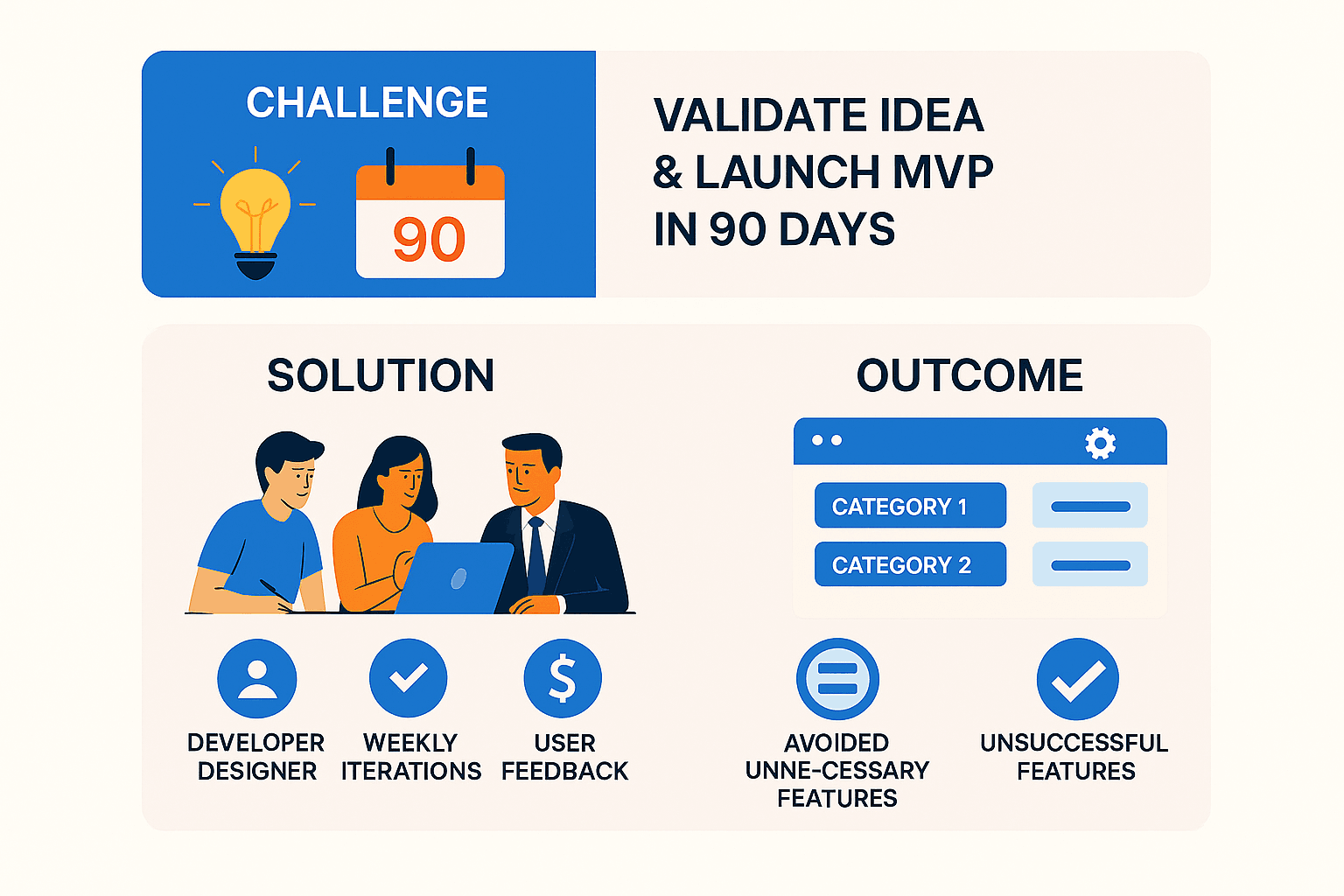

Launching an MVP in 90 days is tough, but it’s possible. Here’s how FinFlow, a financial management startup, did it:

Key Takeaways:

Why It Worked: Early user feedback, clear priorities, and a collaborative, iterative process helped FinFlow avoid common pitfalls like wasted resources and missed market fit. Their success shows that with the right strategy, even tight deadlines are manageable.

FinFlow set out to create a straightforward, customized expense tracker specifically for service-based businesses. Unlike retail businesses, which deal with relatively simple inventory costs, service companies face unique challenges. They juggle project-specific expenses, client reimbursements, and varying contractor payments - areas where existing tools often fall short.

The MVP was designed to tackle three core needs: real-time expense categorization by client or project, smooth integration with QuickBooks and Xero, and instant, client-ready expense reports.

Their target audience? Service-based businesses with 5–50 employees. These companies often have complex expense management needs but lack the resources for dedicated accounting departments. Considering that over 35% of startups fail due to a lack of market demand, FinFlow focused on real, validated pain points. Technically, the platform needed to handle receipt scanning via mobile apps, allow multiple user roles within a single business account, and provide dashboard analytics for spotting spending trends - all while ensuring reliability from day one.

These clearly defined goals led to their decision to commit to an ambitious 90-day development sprint.

With only six months of funding left, FinFlow had to act fast. They set a 90-day deadline to launch their MVP, leaving another three months to gather user feedback and make improvements before their funds ran out. Timing was also critical - tax season was just four months away. This period is when service businesses are most open to adopting expense management tools. Missing this window would have meant waiting a full year for another prime opportunity.

The urgency of the timeline was strategic. Releasing an MVP quickly allows for faster feedback and iteration - key to reaching product-market fit. With up to 90% of startups failing and 29% collapsing due to running out of cash or missing product-market fit, FinFlow couldn’t afford delays. The 90-day sprint forced the team to focus on essential features, avoiding unnecessary additions that could derail the project.

Propelius Technologies stepped in to help FinFlow meet these challenges head-on, delivering a rapid MVP through their proven 90-Day MVP Sprint model - a perfect fit for FinFlow’s tight timeline and limited budget.

The collaboration began with refining the feature list to prioritize only the most critical functionalities, ensuring the first version of the product wasn’t bogged down by unnecessary features.

A cross-functional team was assembled, including React.js and Node.js developers, a UI/UX designer, and a dedicated project manager. Daily standups with FinFlow’s founders ensured that technical decisions aligned with both business goals and user experience priorities.

To ease financial strain, Propelius implemented a shared-risk payment model. FinFlow paid 50% upfront, with the remaining balance due upon successful delivery. Propelius also offered a delay discount - 10% per week, up to 50% - if they missed the deadline, showing their confidence in meeting the timeline.

"Working with Propelius Technologies has been an exceptional experience. Their team is highly professional, technically strong, and committed to delivering quality solutions on time. They understand our requirements perfectly and always go the extra mile to ensure satisfaction. Highly recommended for any tech project!"

- Chaitanya Laxman, CEO, CiaraAI

Using an Agile approach, Propelius conducted weekly prototype reviews. This allowed FinFlow’s founders to test features and give immediate feedback, ensuring the product stayed user-focused. The iterative process made it easy to address small issues early, preventing them from snowballing into larger problems later in development.

The prototyping journey kicked off with a focused effort to gather requirements during the first week. Propelius Technologies facilitated workshops with FinFlow's founders to identify key stakeholders and define the core goals for the MVP. This groundwork was essential, as miscommunication is a leading cause of project failures - accounting for 70% of them, according to research. With a tight timeline, the team knew clear communication was non-negotiable.

To dig deeper, Propelius conducted one-on-one interviews with the founders and hosted a brainstorming session with the tech team. These steps helped map out user stories and anticipate potential challenges. They examined how various types of service business owners, from solo consultants to small agencies, would interact with the platform’s expense tracking features.

"Requirements gathering is the process of identifying your project's exact requirements from start to finish." - Team Asana

A RACI matrix was used to clarify roles and streamline decision-making. The founders of FinFlow were consulted on all business logic decisions, while Propelius took responsibility for the technical implementation and meeting deadlines. Every requirement was documented, validated by stakeholders, and prioritized based on user impact and technical feasibility. Key features like real-time expense categorization, accounting software integration, and instant reporting capabilities were front and center. These defined requirements became the foundation for the weekly prototyping cycles.

Propelius adopted a weekly prototyping cycle, progressively refining the platform in seven-day sprints. Starting with low-fidelity wireframes, the team developed high-fidelity interactive prototypes by week six.

Each iteration was tested with real potential users - service business owners who mirrored FinFlow’s target audience. Propelius recruited participants and conducted short user testing sessions every Friday. These sessions provided actionable insights, such as the discovery in week five that users wanted to photograph receipts directly within the app, rather than uploading them from their camera roll. This feedback led to the integration of native camera functionality.

Using an agile approach, each week’s prototype built on the previous version, incorporating both user feedback and technical learnings. By week eight, the team had created a fully functional prototype with all core features intact, leaving room for final tweaks and bug fixes in the remaining weeks. This iterative process ensured the team stayed aligned and prepared for the next phase.

The iterative prototyping process thrived on strong cross-functional collaboration, ensuring user insights were seamlessly integrated into the product. By adopting Scrum, the team maintained daily standups and weekly sprint reviews to keep everyone aligned.

| Role | Key Responsibilities | Collaboration Focus |

|---|---|---|

| Product Manager | Prioritizing features, managing stakeholder communication | Regular check-ins with FinFlow founders and coordinating user testing |

| UI/UX Designer | Designing user experiences, creating prototypes | Partnering with developers to ensure designs were feasible and incorporating user feedback |

| React.js Developer | Developing the frontend, implementing interfaces | Collaborating with designers and connecting APIs with the backend team |

| Node.js Developer | Handling server-side logic, database design, and APIs | Running integration tests with the frontend and managing third-party API connections like QuickBooks and Xero |

| QA Engineer | Testing, identifying bugs, ensuring quality | Conducting continuous testing and overseeing user acceptance testing |

Communication tools like Slack for daily updates and Figma for design collaboration kept the team connected. Weekly feedback sessions, held every Wednesday, gave the designer the chance to present updated mockups while developers raised technical considerations and ideas.

"In fast prototyping, effective teamwork depends on well-defined objectives, cross-functional participation, and consistent communication." - Umair Yahya, Principal Product Designer at Zension

By involving all team members, including QA, in design reviews, the team avoided integration hiccups. For example, the backend developer participated in user testing sessions to better understand how technical choices affected the user experience.

An experimental mindset also played a key role. When the designer proposed a drag-and-drop feature, it was prototyped in just two days. This collaborative and flexible approach helped the team tackle technical and time constraints, setting the stage for the challenges explored in the next section.

Even with a structured plan in place, FinFlow encountered several hurdles that threatened the 90-day timeline. These challenges pushed the team to think on their feet and stay committed to delivering a high-quality product.

One major issue cropped up in week four during the integration process with third-party accounting software APIs. QuickBooks and Xero, the two platforms in question, used different authentication protocols and data formats, leading to delays. This isn’t uncommon - 30% of developers report integration issues as a common cause of project delays.

To tackle this, Propelius introduced mock APIs, allowing the backend team to work on the complex integrations while the frontend team continued building features using simulated data. They also adopted a modular architecture that separated the integration layer from the core business logic. This setup turned out to be a lifesaver. For instance, when the QuickBooks integration became unexpectedly complex, they were able to quickly switch to alternative solutions without overhauling the entire expense tracking system. Similarly, when troubleshooting Xero’s API documentation took extra time, the modular design kept progress on other fronts steady.

By week seven, all integrations were up and running. The team also learned an invaluable lesson - addressing technical dependencies early. Moving forward, they committed to conducting technical feasibility reviews in the first week of a project to avoid similar pitfalls.

The tight timeline posed another challenge in week six when user testing revealed that the expense categorization feature needed a complete redesign. Users found the original interface confusing, and redesigning it without extending the timeline seemed nearly impossible.

Propelius responded by prioritizing tasks using the MoSCoW framework (Must have, Should have, Could have, Won’t have). They identified automatic expense categorization as a "must-have" feature critical for launch, while advanced reporting was deferred to a later update. This focused approach allowed the team to zero in on what mattered most.

The small team structure also worked in their favor. The product manager maintained close communication with FinFlow's founders, securing approvals in hours instead of days. Daily standups ensured that any blockers were addressed immediately, keeping the project on track.

To maintain quality under such tight deadlines, the team leaned heavily on continuous code reviews and automated testing. Studies show that teams performing regular code reviews can reduce bugs by 55%. By having the QA engineer work alongside developers during each sprint, the feedback loop shrank from days to hours, preventing technical debt from piling up. This approach ensured that the team could move quickly without compromising on quality.

By week five, user feedback presented another challenge. The team received input from 15 potential users, but the suggestions were conflicting. Some users wanted more automation, while others preferred manual control over expense categorization.

To make sense of the feedback, Propelius combined qualitative insights from user interviews with quantitative data collected through basic analytics tracking in the prototype. This helped them identify which features users engaged with the most. Ultimately, they decided to focus on automated functionality, as it aligned with the majority's needs. Interestingly, 45% of product managers rely on customer feedback for decision-making.

Weekly feedback sessions were revamped to focus on resolving user blockers rather than minor tweaks. For example, when users reported issues uploading receipts, the team prioritized fixing this over less critical suggestions like adding expense approval workflows, which were documented for future updates.

To build trust with early adopters, the team sent out quick updates on the changes they implemented based on user feedback. This practice encouraged more detailed and actionable input in subsequent testing sessions, creating a stronger connection with users.

These challenges not only led to a better final product but also provided essential lessons for managing future 90-day sprints. The experience showed that with the right processes and team dynamics, even significant obstacles like technical issues, tight deadlines, and conflicting feedback can be successfully navigated.

FinFlow's journey offers valuable lessons for launching MVPs quickly and effectively.

Initially, FinFlow struggled with unclear user needs, but early testing turned things around. By testing basic wireframes in just the second week, they were able to slash development costs by up to 30% and cut their time-to-market in half. Catching and addressing issues during the prototype stage turned out to be far cheaper - up to 100 times less expensive - than fixing problems after launch.

The team adopted a systematic approach to gathering feedback, conducting regular user interviews and observation sessions. Watching users interact with prototypes provided five times more actionable insights than relying on discussions alone. This hands-on feedback process contributed to a 63% increase in the likelihood of a successful product launch.

"When users can interact with a prototype, their feedback becomes significantly more valuable." - Nielsen Norman Group

Armed with these insights, FinFlow realized the importance of starting small and building incrementally.

FinFlow's success hinged on beginning with simple wireframes and gradually adding complexity. Instead of diving into a fully-featured prototype, the team prioritized core functionality first. This strategy allowed them to bring their MVP to market 40% faster than teams aiming for fully developed prototypes from the start.

The process began with paper sketches, which evolved into clickable wireframes, enabling continuous validation and refinement. By testing and improving each feature step by step, they ensured that the final product was polished and user-friendly.

This incremental approach not only streamlined development but also reduced the risk of product failure by up to 40%. With a solid foundation in place, finding the right development partner became the next crucial step.

Partnering with Propelius Technologies proved to be a game-changer for FinFlow. Propelius's 90-Day MVP Sprint model perfectly matched FinFlow's ambitious timeline, and their shared-risk pricing structure demonstrated a strong commitment to the project's success.

Post-launch, Propelius's support ensured that any issues were quickly resolved. Transparent communication and seamless collaboration kept the project on track, allowing FinFlow to save both time and money.

"The right MVP development partner isn't just a vendor - they're your strategic ally in innovation. Choose wisely, and the possibilities are endless." - Christian Gylseth

With enterprise software spending expected to hit $1.25 trillion by 2025, partnering with a team that combines technical expertise and strategic insight is more important than ever. Propelius's mix of innovation, clear communication, and risk-sharing played a critical role in delivering a high-quality MVP within just 90 days.

FinFlow showed how collaborative prototyping and a strong development partner can transform a 90-day challenge into a market-ready MVP. Their success stemmed from prioritizing early user feedback, embracing iterative development, and forming risk-sharing partnerships. These strategies offer valuable insights for any startup aiming to launch quickly and effectively.

A key driver of FinFlow's success was its unwavering focus on early and ongoing user engagement. By testing prototypes early, they avoided common pitfalls like market misfit. This approach is similar to how Instagram initially launched as a single-feature MVP centered on photo sharing to validate user interest.

Their commitment to iterative development also played a critical role. Like Dropbox's early strategy, FinFlow tested concepts before heavily investing resources. This allowed them to refine their product based on real user interactions, ensuring it met market needs.

Partnering with Propelius Technologies proved to be another cornerstone of their success. Propelius' 90-Day MVP Sprint and shared-risk model aligned perfectly with FinFlow's goals. As engineering expert Dima Kushch explained:

"MVP development balances essential market needs with rapid, efficient execution."

These lessons provide a clear roadmap for startups looking to replicate FinFlow's success.

For startups, focusing on core functionality from day one is essential. With 91.3% of businesses already leveraging MVP strategies, staying competitive requires rapid execution and thorough user validation. Start with low-fidelity prototypes - like sketches or wireframes - to enable quick, cost-effective iterations.

Define clear KPIs at the beginning of the project. Metrics like user acquisition, customer satisfaction, or product adoption will help guide focused development.

Finally, choose your development partner wisely. FinFlow's experience highlights the importance of working with teams that have proven expertise in MVP development. Look for partners who can provide technical solutions tailored to your needs and offer post-launch support for bug fixes and updates, as the process doesn’t end at launch.

FinFlow’s journey proves that collaborative prototyping, combined with the right partnerships, can make a 90-day MVP launch not just possible but repeatable.

FinFlow concentrated on the essential features needed to prove their MVP's concept. They zeroed in on critical functionalities such as GIF generation and payment workflows, making sure these features met user expectations and aligned with the product's main objectives.

With just 90 days to deliver, they balanced speed and quality by combining exploratory testing with scripted manual testing. This method allowed them to quickly spot and fix issues, ensuring the MVP was both functional and easy to use by the deadline.

Propelius Technologies makes it easy to connect with accounting tools like QuickBooks and Xero. They offer a free data conversion tool, pre-designed CSV templates for seamless data imports, and a team of skilled specialists to ensure your transaction histories and account setups are transferred accurately. This way, businesses can switch systems effortlessly, keeping their financial operations running smoothly without interruptions.

Using a shared-risk payment model in collaborative prototyping brings some clear advantages. It aligns the goals of all parties involved, creating a sense of shared responsibility and commitment to the project's success. This setup motivates both sides to focus on delivering quality results while keeping costs in check.

Another benefit is the fair distribution of financial risks. For startups, this means they can pursue innovation without shouldering all the upfront costs. By pooling resources and expertise, this approach can also speed up development timelines - especially important for projects with tight deadlines, like launching a 90-day MVP.

Need an expert team to provide digital solutions for your business?

Book A Free CallDive into a wealth of knowledge with our unique articles and resources. Stay informed about the latest trends and best practices in the tech industry.

View All articlesGet in Touch

Let's Make It Happen

Get Your Free Quote Today!

Get in Touch

Let's Make It Happen

Get Your Free Quote Today!